The long-awaited release of Odoo 19 is on the horizon, businesses & accounting professionals worldwide are eager to discover the innovative new features coming to the Accounting module. As Odoo continues to transform ERP, this latest version promises important upgrades designed to streamline financial operations, enhance automation & improve regulatory compliance.

Based on Odoo's development trends and user community feedback, we expect Odoo v19 to introduce special improvements across several key accounting functions.

➢ Bank transactions with PDF preview

•With Odoo 19 now you can preview attached documents directly in the bank transaction list view whenever a document is linked to a statement.

➢ Contact form revamp

• With Odoo 19, the contact form view and model have been revamped with a new UI.

➢ Debit notes

• With Odoo 19, the Debit note option in the Action menu has been replaced with a separate dedicated button.

➢ Follow up via WhatsApp

• With odoo 19, now users can use WhatsApp messages on follow-up levels. The total amount, representing the invoice amount converted into the company's currency, is available as a measure in the improved odoo 19’s invoice Analysis report.

➢ Invoice analysis

• The total amount, representing the invoice amount converted into the company's currency, is available as a measure in the improved odoo 19’s invoice Analysis report.

➢ Bank statement OCR manual correction

• Once a statement has been processed through OCR, manually adjust the Starting Balance and Ending Balance by clicking on each field and selecting the correct value directly from the PDF.

➢ Follow-up report

• Odoo 19 introduces a new version of the partner ledger, called the Follow-up Report. It’s separate from the customer statement, this report focuses specifically on overdue invoices, distinguishing them from those that are simply due. This is one of the key Odoo 19 features designed to support more efficient follow-up processes, and it can be accessed from the reporting section.

➢ Reconcile draft entries

• Draft entries are now eligible for reconciliation. Any resulting automatic moves—such as currency exchange differences or cash basis adjustments—are created as draft entries at the time of reconciliation. Once the original entry is posted, the reconciliation is automatically confirmed.

➢ Follow-up/partner ledger access to Invoicing and banks

• Odoo 19 Accounting enables Invoices now provides access to the Account Report module and activates Partner Reports by default.

• These features are available to both Invoicing users and Accounting users who have only "Invoicing & Banks" access rights.

➢ Bank reconciliation interface

• Under odoo 19, the bank reconciliation interface has been streamlined for ease of use, and automated reconciliation models have been enhanced to improve transaction recognition accuracy.

➢ Fiscal positions

• Tax mappings within fiscal positions have been removed. Now, each tax specifies the fiscal positions in which it applies (leaving it empty makes it applicable to all) and identifies which taxes from other fiscal positions it replaces.

• Ex : A 0% export tax can be added to replace national sales taxes when the Export fiscal position is used. On invoices, taxes are automatically filtered based on the selected fiscal position, while on products, they default to the Domestic fiscal position (i.e., the first listed one).

➢ Annual statements composite report

• The default Annual Statements composite report streamlines year-end reporting by combining the balance sheet, profit and loss statement, and trial balances into a single report, allowing users to print all of them at once.

➢ Cash discounts

• In Odoo 19 inside the Accounting module added a new option, "Always (upon invoice)", which has been used for tax reduction on payment terms that include a cash discount.

➢ Duplicate bill detection

• When a potential duplicate bill is detected, a warning banner remains visible even after the bill is posted, and the Reference field of the affected bills is highlighted in the list view. Additionally, duplicate bills are excluded from automatic posting.

➢ Light audit trail

• With odoo 19 accounting the non-restrictive audit trail is now enabled by default for all users.

➢ Tax return in Odoo 19 Accounting

• A new Tax Return feature has been introduced to manage fiscal return obligations & deadlines, with built-in automated validation checks to ensure accurate filings. It is also customizable to support localization requirements across various regions.

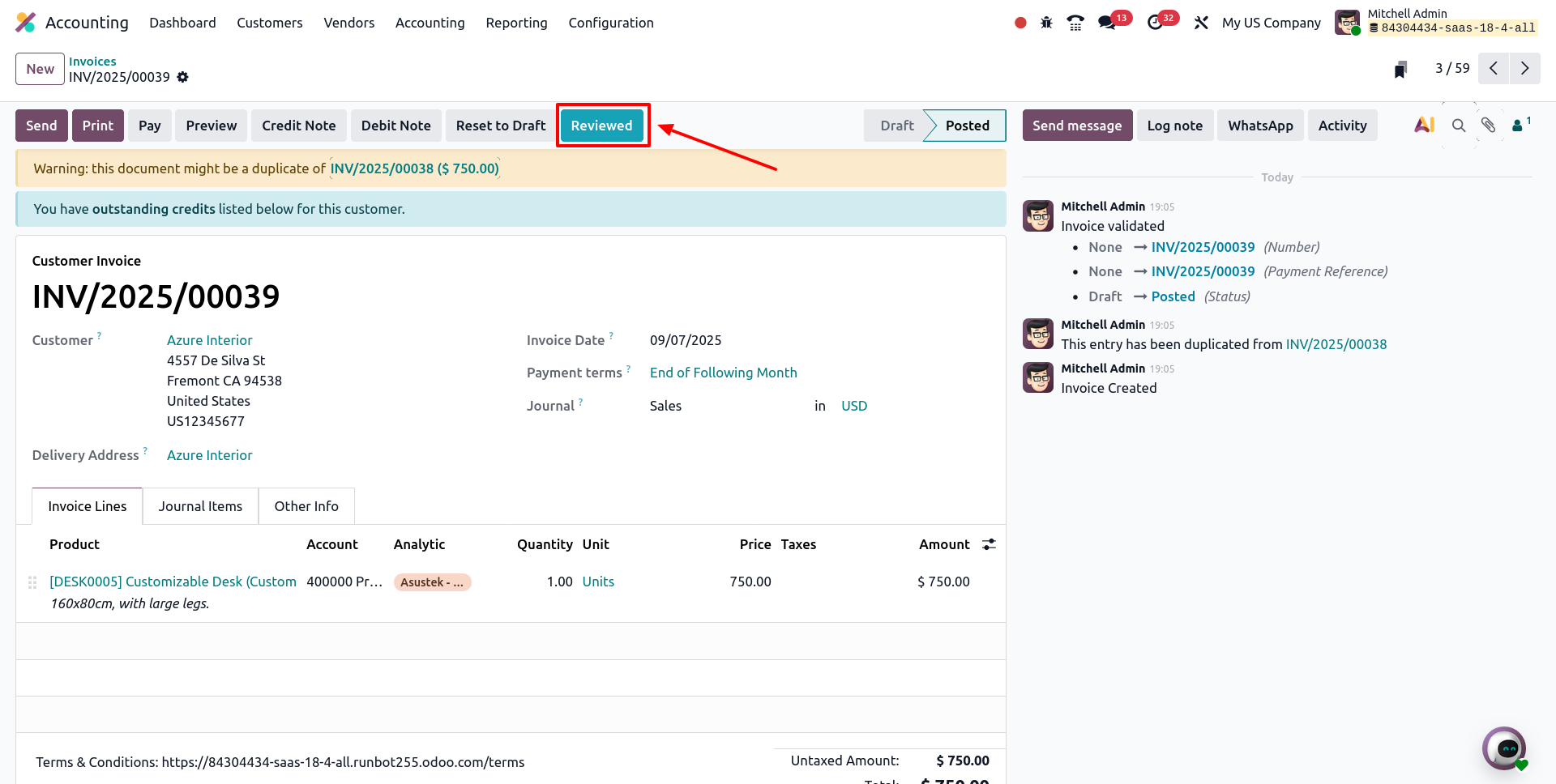

➢ Review invoices

• Users with basic invoicing access (like "Invoicing" or "Invoicing & Banks") can create and post invoices. However, these invoices are automatically marked as "To review" so that accountants (with "Bookkeeper" or "Administrator" access) can double-check them.

Once an accountant reviews and confirms the invoice, invoicing users can no longer make changes to it.

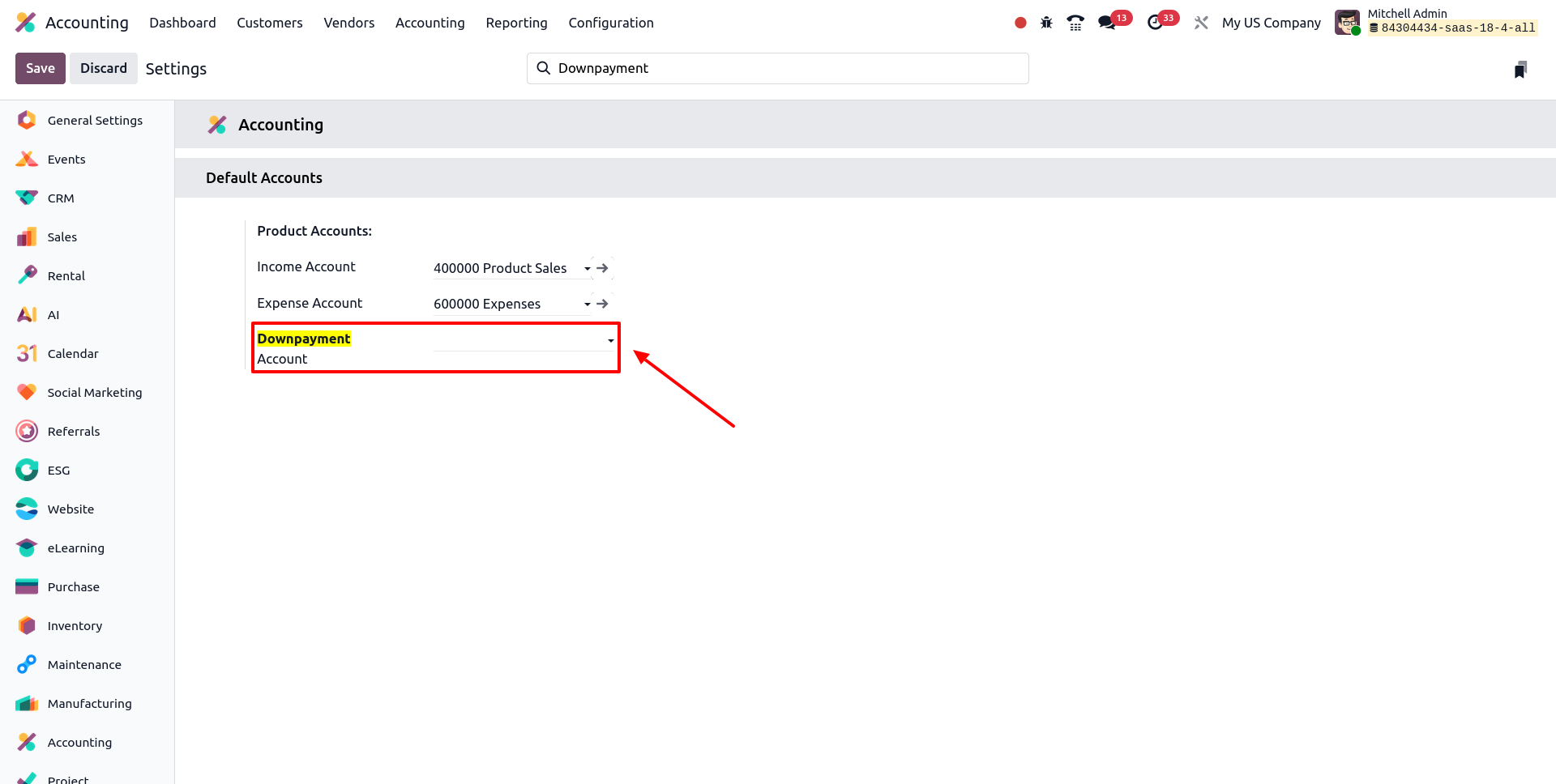

➢ Down payment account

• The Down Payment Account option is no longer found under the Product Category. It has now been moved to the Accounting Settings section, making it easier to manage from one central place.

➢ Payment communication generation

• Payment communication formats are now clearly defined with illustrative examples. Enhancements have been made to the European standard, and a new "numbers only" format has been introduced to accommodate countries that do not support special characters in payment references.

➢ Charge bearer on individual payments

• Now you can define the charge bearer for each individual payment when creating batch payments in ISO 20022 payment files.

➢ Print & Send

• The layout and usability of the Send & Print wizard have been improved, along with enhanced accessibility of Print menu options. Additionally, action reports and templates are now more customizable through Studio, allowing for easier personalization and configuration.

➢ Invalid statement warning

• Users now receive instant alerts when an invalid statement is detected, enabling quicker identification and resolution of issues.

➢ Updated action names

• Menu item action names have been revised to generate more readable and user-friendly URLs.

➢ ISO20022 - Instruction priority

• The priority instruction can now be specified on payments using the ISO 20022 payment method and its variants, allowing users to indicate the urgency level of each transaction.

➢ Menu and form organization and layout

A new Journal Creation Wizard has been added to the Dashboard, featuring integrated bank and credit card account synchronization.

The Journal & Reconciliation Models form views have been improved for usability.

Invoice line display settings are now stored separately for customer invoices & vendor bills, enabling clear configurations for outgoing & incoming invoices.

➢ Reset invoices/bills to draft

Starting from previous Odoo version 18.0, resetting an invoice or bill will now detach the already generated invoice document.

➢ Account selection

Account descriptions can now be added to clarify when and how each account should be used.

Default taxes set on accounts are applied only to invoices and bills, not to miscellaneous journal entries.

On invoices, the system prioritizes income accounts, while on bills, it suggests expense and fixed asset accounts first. These filters can be manually overridden if necessary.

➢ Deferred miscellaneous entries

• Start and end dates have been added to miscellaneous entries, enabling the deferral of bills to receive and invoices to issue for more accurate period-based reporting and accrual management.

➢ Partially reconciled items

• With Odoo 19 you can either fully reconcile items or write off partially reconciled ones.

➢ Analytic subplans

• Tracking budgets and generating analytic reports is now easier. Odoo has improved how analytic subplans are organized and managed in a hierarchy.

➢ Payment withholding tax

• You can now apply withholding tax directly on payments — a new feature available starting from version 18.0. This helps ensure tax compliance at the payment level.

➢ Purchase order matching

• When you import vendor bills using XML or OCR, Odoo will automatically search for purchase order references — not just in standard fields, but even within line descriptions — to match them with existing purchase orders.

➢ Unified Purchase and Sales Receipts

• Odoo has simplified how receipts and invoices work: Purchase receipts are now part of the vendor bill form. You can choose between a bill or a receipt. Sales receipts can be turned on from the settings. Also, local tax rules can now override default taxes to match your country’s specific regulations.

➢ Conclusion

Odoo 19 Accounting module is the important solution, seamlessly integrating with other functionalities to automate financial processes, enhance accuracy & support data-driven decision-making.

As an official Odoo partner, SerpentCS delivers comprehensive Odoo ERP Services tailored to diverse business requirements. We have successfully implemented numerous ERP projects for startups and small-to-medium enterprises globally. For more details, Contact Us today.