Singapore Localisation

Stay Compliant, Stay Ahead

About Singapore Localization

-

This module is developed to enable your Singapore operating company to manage all Singapore Standards and Practices in Odoo.

-

Our SG Localisation module is designed and developed for the HR, Payroll and Accounting configuration in Odoo to take care of your country – Singapore accounting localisation.

-

This module has detailed configuration available for HR, Payroll, Accounting with Salary Rule configuration in Odoo, Leave Management, Holidays in Odoo, and Account and Tax configuration in odoo.

-

This module will allow you to manage multi-currency transactions in odoo and multi-currency configuration.

-

Singapore Odoo Localisation Module generates IRAS Report and GST Report for printing.

Features

Chart of Accounts

Predefined Singapore-compliant chart of accounts tailored for local accounting standards.

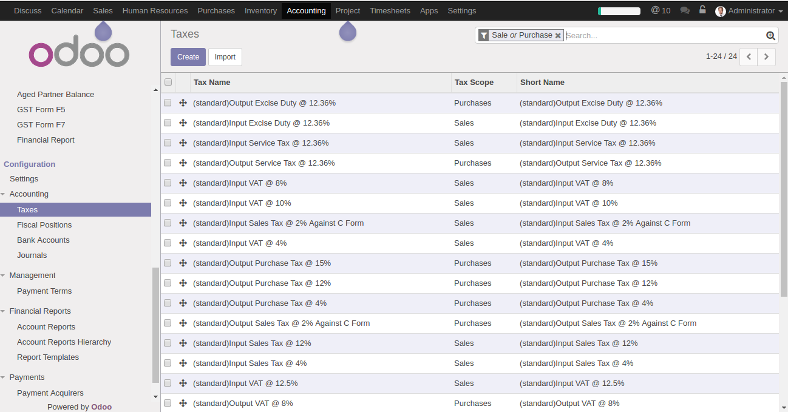

Chart of Tax

Localized tax structure including GST setup, aligned with Singapore’s regulatory requirements.

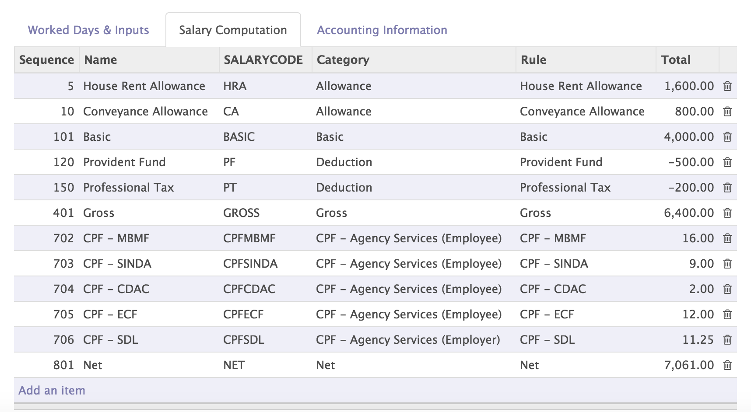

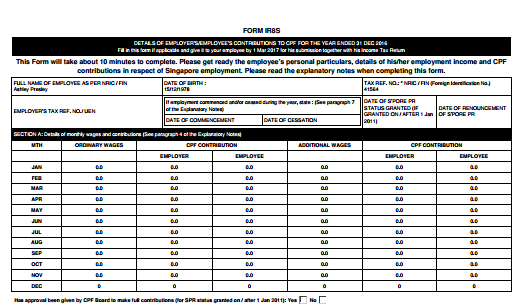

Pay-slip with CPF

Generate pay-slips with automatic Central Provident Fund (CPF) contributions as per Singapore rules.

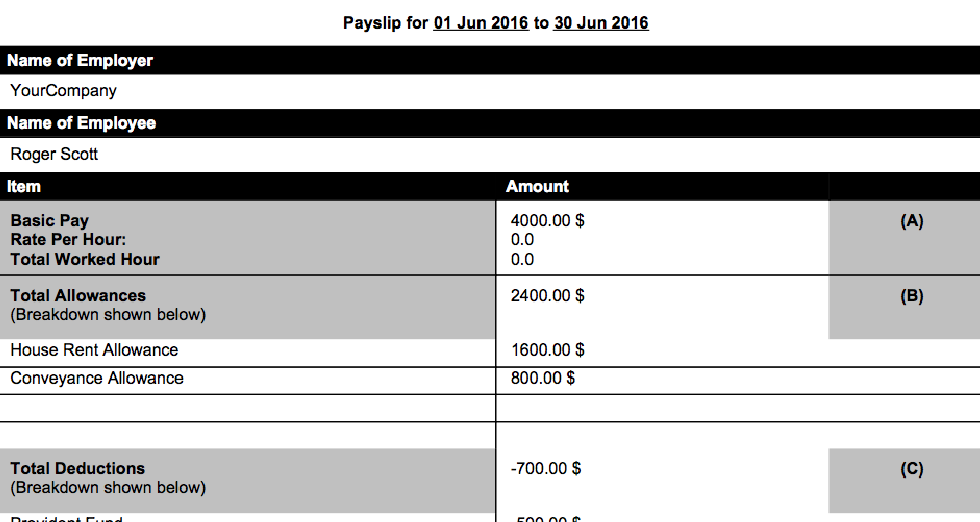

Pay-slip Report

Detailed pay-slip reports including breakdowns for employee and employer CPF contributions.

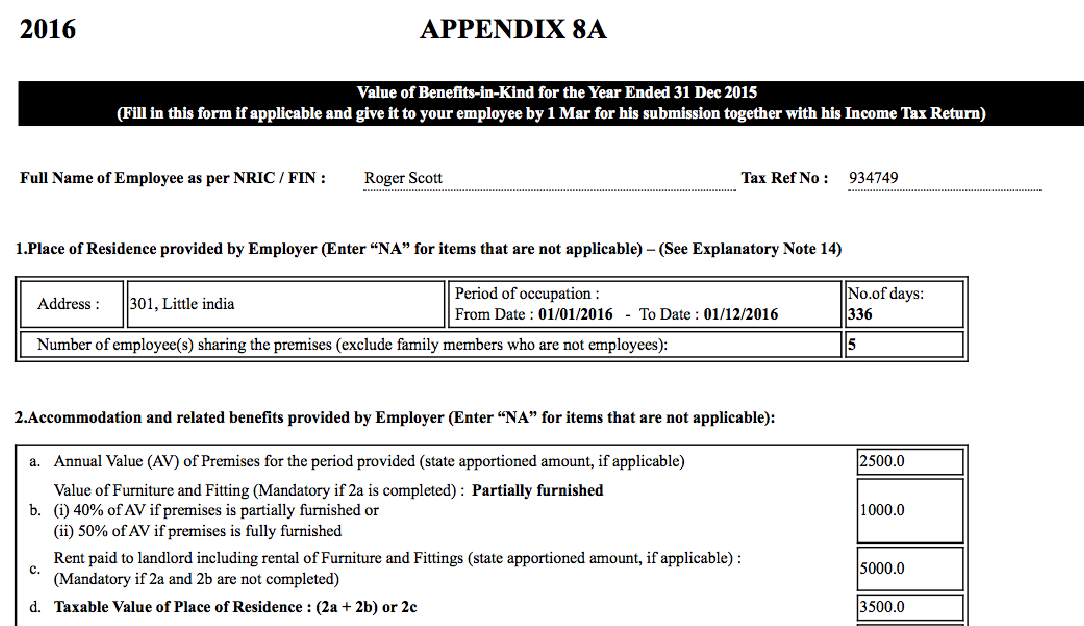

Regulatory Reports

Generate key compliance reports such as IR8A, IR8S, GST Form 5 & 7, and pipe-delimited e-tax files. Includes PDF and TXT formats and various payroll reports like YTD summaries, bank/cheque payments, and pay-slip details.

Visual Walkthrough

Explore our Singapore Localization Modules

Learn How Odoo Singapore Localization Module Works

Get Started with Ease!

Contact Us

We're Just a Message Away!